Back to Articles

Back to Articles

Verification on EXMO

The verification process on EXMO may seem complicated, but if you just follow some simple steps, the process is extremely straightforward and easy. This article will walk you through the basic verification steps required to start trading on the EXMO platform.

Why is verification needed?

EXMO is a cryptocurrency exchange that is registered in the UK and operates under the jurisdiction of the British legal system, as well as the EU legal system. According to the Fifth Anti-Money Laundering Directive (5AMLD), all users who transact with cryptocurrency must undergo mandatory identity verification.

We understand that anonymity is crucial for all traders, but we assure traders of EXMO that your data will be reliably protected and secure. All documents and data obtained during the verification process are stored on encrypted servers and only a certified AML officer has access to this data. On copies of documents, special watermarks are superimposed, which do not allow the documents to be reused.

What is verification?

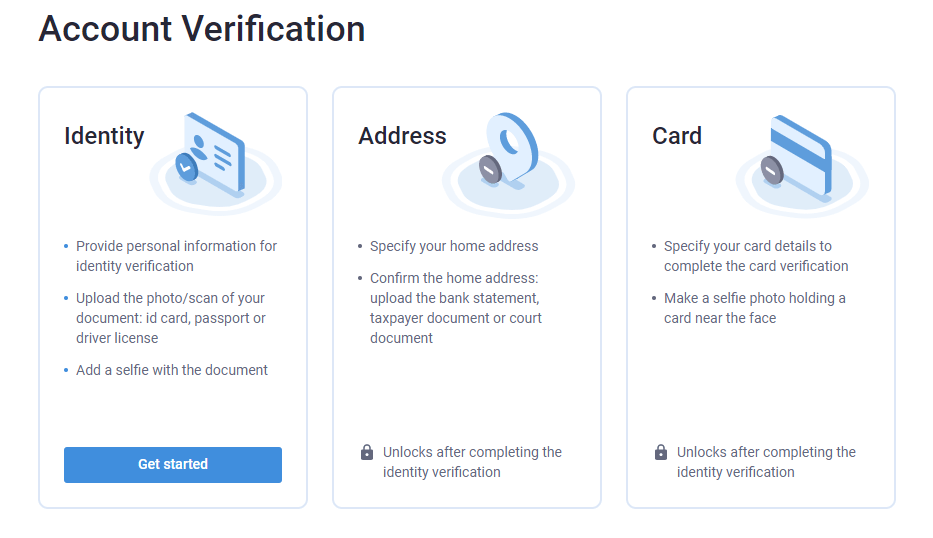

Verification is the process of confirming the identity of a trader on EXMO. Verification can be done immediately following registration, and for this, you need to navigate to the “Account Verification” section in your account.

There are five verification stages on the platform:

- Identity Verification

- Address Verification

- Card Verification

- Bank Account Verification

- Corporate Account Verification

Verification levels required for different payment methods: FAQ.

How to pass verification on EXMO?

A trader can be verified by accessing their account via the EXMO website or through the EXMO mobile application. Verifying through the EXMO mobile application is a more convenient option because you will require to take photos and scans of documents to upload and submit. It is more convenient to take photos and scans and submit them using a mobile device than to transfer files from gadgets to a computer.

You will be able to proceed with verification after successful registration on the platform. To start the procedure, go to the Account Verification section and click “Get Started” to confirm your identity. After successfully passing, you can verify your address and/or card if necessary.

Identity Verification

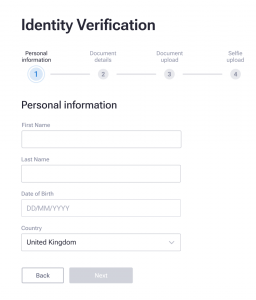

Identity verification on EXMO is mandatory and provides access to the main functions of the exchange – trading, deposits and withdrawals. To successfully pass the identity verification, you need to follow four steps:

- Fill in your personal information – First/Last/Middle name, DOB and Country of residence.

- In the details field of the document, select the type of document. Passport, National ID/Card or a Driver’s License are accepted as valid forms of ID. Enter the appropriate serial/document number, the date of issue and the validity period of the document (if there is no validity period specified, then mark the field “My document hasn’t got an expiration date”).

- Upload a scanned/photo of the document (the front side of the driver’s license/ID card or the first two pages of the passport are clearly visible).

- Upload a selfie photo with the document next to your face.

Note:

Accepted scanned/photo file formats: JPEG, PDF or PNG.

Size limit: 100KB – 8MB.

Confirmation of successful verification usually takes up to 2 hours. However, please be aware that the verification process may take up to 24 hours in some instances, in order to comply with rules. After successfully passing identity verification, a trader will be able to verify their address and bank card.

Once a trader has successfully confirmed their identity, they can trade on EXMO, deposit and withdraw cryptocurrency from their account, carry-out transactions using AdvCash or Payeer.

Address Verification

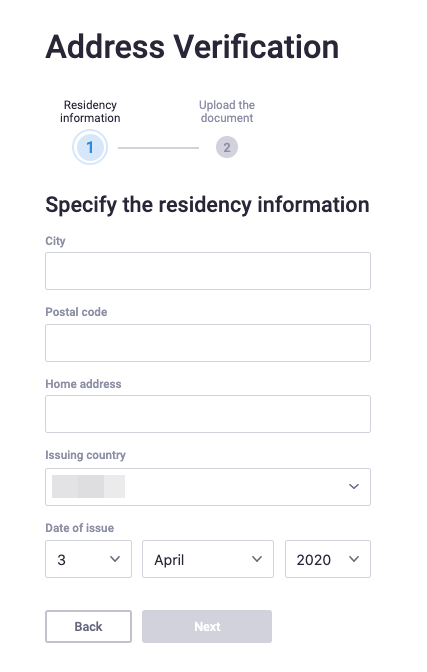

To verify an address, a trader is required to provide information to prove their place of residence and upload a document confirming this information. For this, a bank statement, utility bill or tax document are accepted.

To verify the address, the user needs to submit the following types of documents:

- Bank statement

- Utility bill

- Tax documents

- Proof of residence issued by a local authority

Address verification involves two simple steps:

- Fill in details of your place of residence: home address, city, zip code, country of issue of the document and date of issue.

- Upload the document confirming the information submitted as part of the previous step.

Note:

The date of issue of the document to prove the place of residence must be no older than 3 months. The document must also clearly display the trader’s full name and home address.

Address verification allows traders to make use of additional payment systems. See the full list here.

Card Verification

Card verification is required to confirm ownership and possession of a bank payment card by a trader.

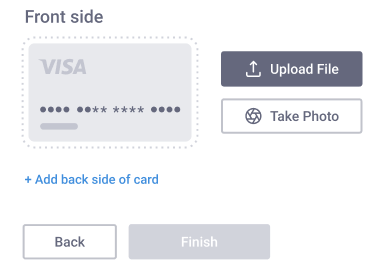

Bank card verification involves two simple steps:

- Fill in details the name and surname of the cardholder, as well as the first 6 and last 4 digits of the card.

- Upload a photo of the front side of the card (add the back side of the card if the cardholder’s name is printed on the backside of the card).

Note:

Please note that only embossed cards issued in the trader’s name are accepted. The name on the card must match the name of the account holder, and the first 6 and last 4 digits of the card must be clearly visible in the photo.

Bank card verification makes it possible to deposit funds from bank cards (for withdrawals to a card, only identity verification is required).

Bank Account Verification

Bank account verification is required to transfer funds using a bank account. This verification step ensures that funds in an EXMO exchange account are credited to and withdrawn from a verified and legitimate bank account.

To verify your bank account, contact us on [email protected].

Note:

Please indicate in the email that you wish to go through bank account verification.

Corporate Account Verification

Corporate account verification is required for corporate clients or companies that wish to use one account and/or provide access to this account to their employees or business partners.

To verify your corporate account, please contact us on [email protected].

Note:

Please indicate in the email that you wish to go through corporate account verification.

Dear users, while passing verification, EXMO recommends paying attention to details. Take your time and adhere to all the tips listed in the article. Then the verification process will be as quick and easy as possible.

Frequently Asked Questions (FAQ)

If you were registered on the exchange before the mandatory verification was implemented, trading would be available to you. However, all new users need to verify their identity to trade, deposit and withdraw funds on EXMO.

Verification on EXMO provides access to the main tools of the exchange. After confirming your identity, you will be able to trade, as well as deposit and withdraw funds. Nevertheless, to use payment methods such as SEPA, SWIFT, Payza, Wire Transfer, Western Union, and MoneyGram money transfer systems, and withdrawal of fiat funds to Visa / Mastercard, you must also verify the address and/or card.

The introduction of mandatory verification on the EXMO exchange is in compliance with the Fifth Directive Against Money Laundering (5AMLD) entering into force. Since our platform is registered in the UK and operates under British jurisdiction, verification is mandatory for all users of the exchange. It is also an additional security guarantee. Each trader can be sure they will not involuntarily become a participant in illegal operations conducted by other users.

To withdraw and deposit funds on the EXMO exchange, you must pass mandatory identity verification.

The process of passing one verification stage depends on individual factors and is usually completed in a timely manner. After uploading the documents and filling in all the forms, the application is sent to the Verification Department. The reviewing process takes up to 24 hours.

The verification of identity, card, and address must be completed once. All re-verifications are due to expired documents.

If you are a representative of a company and intend to conduct work on our platform as a legal entity, send your request to [email protected]. A response letter will contain a list of required documents.

For successful verification, only original documents can be used. Scan copies must also be in colour. A full list of requirements is available here.

For the convenience of users, verification is also available in the EXMO mobile application for Android and IOS.