Back to Articles

Back to Articles

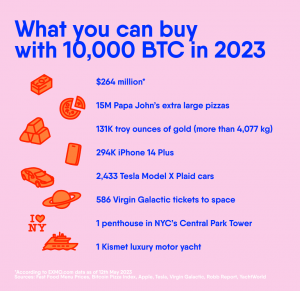

Bitcoin Pizza Day: what you can buy for 10,000 BTC in 2023

On 22nd May every year, crypto enthusiasts all around the world celebrate Bitcoin Pizza Day. Find out what you can buy today for 10,000 BTC.

What is Bitcoin Pizza Day

In 2010, the crypto fan and programmer, Laszlo Hanyecz, made the first documented commercial transaction with bitcoin. He bought two Papa John’s pizzas for 10,000 BTC on a bitcointalk.org forum. At the time, this huge amount of bitcoins was worth only $41.

During the next years, the price of bitcoin significantly increased, hitting an all-time high of $68,888 on EXMO.com on 10th November 2021. Currently, 10,000 BTC is worth approximately $264,000,000, allowing its holders to buy much more than just two pizzas!

What else can you buy with Bitcoin?

First of all, you can still buy pizza with BTC. For instance, the Lightning Pizza platform allows you to pay for Domino’s pizza in bitcoins. Also, you can buy Papa John’s Pizza or Domino’s gift cards with BTC via services like Gyft and eGifter. Besides that, there are lots of restaurants supporting bitcoin as accepted payment.

Subway. In November 2022, three Subway restaurants in Berlin began accepting payments in BTC.

Burger King. The popular hamburger fast food restaurant chain currently accepts bitcoin in Paris.

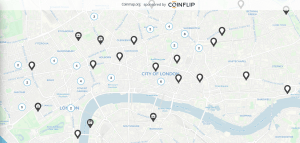

You can also look for restaurants, cafes, and retailers that accept bitcoin in your area on the Coinmap platform.

Coinmap shows how many retailers and food facilities accept BTC in London, England.

Besides this, you can use bitcoin to pay for many other goods and services.

Utilities. The Bill Pay for Coins service allows you to pay bills and invoices with BTC. For each transaction, the platform charges users a $1.25 + 1.25% fee ($2.49 min).

Rent and trips. The blockchain-based travel booking platform, Travala, allows you to pay for hotels and accommodations with BTC and other cryptocurrencies. Another platform accepting Bitcoin is the Spanish-based agency, Destinia.

Real estate. You can use BTC to buy luxury apartments and houses in different parts of the world via crypto real estate services.

Cars. Platforms such as BitCars or AutoCoinCars allow you to purchase not only mid-range cars, but also motor homes, vintage cars and even supercars.

Electronics. Online marketplaces like GipsyBee, Newegg, and Scan.co.uk accept BTC for purchasing electronics and other goods.

Freelance services. Platforms like CryptoTask, Coinlancer, BitGigs, BitforTip and CryptoJobs allow you to receive paychecks and pay for freelancers’ work with BTC.

Charity. Red Cross, United Way, Wikimedia Foundation and UNICEF are among the non-profit organisations and charities that accept cryptocurrency.

Besides that you can also buy luxury jewelry, cosmetics, online games and even pay for a Time magazine subscription with BTC.

How to celebrate Bitcoin Pizza Day?

The best way to celebrate the first-ever commercial transaction using bitcoin is to eat pizza! It’s up to you how and where to buy it — through the Lightning Pizza platform or directly from a restaurant. Just remember to get BTC first!